alabama tax lien association

The association might choose to foreclose its lien. How much authority do HOAs have and what can they require and enforce in Alabama.

Get The Property Training Us Tax Lien Association

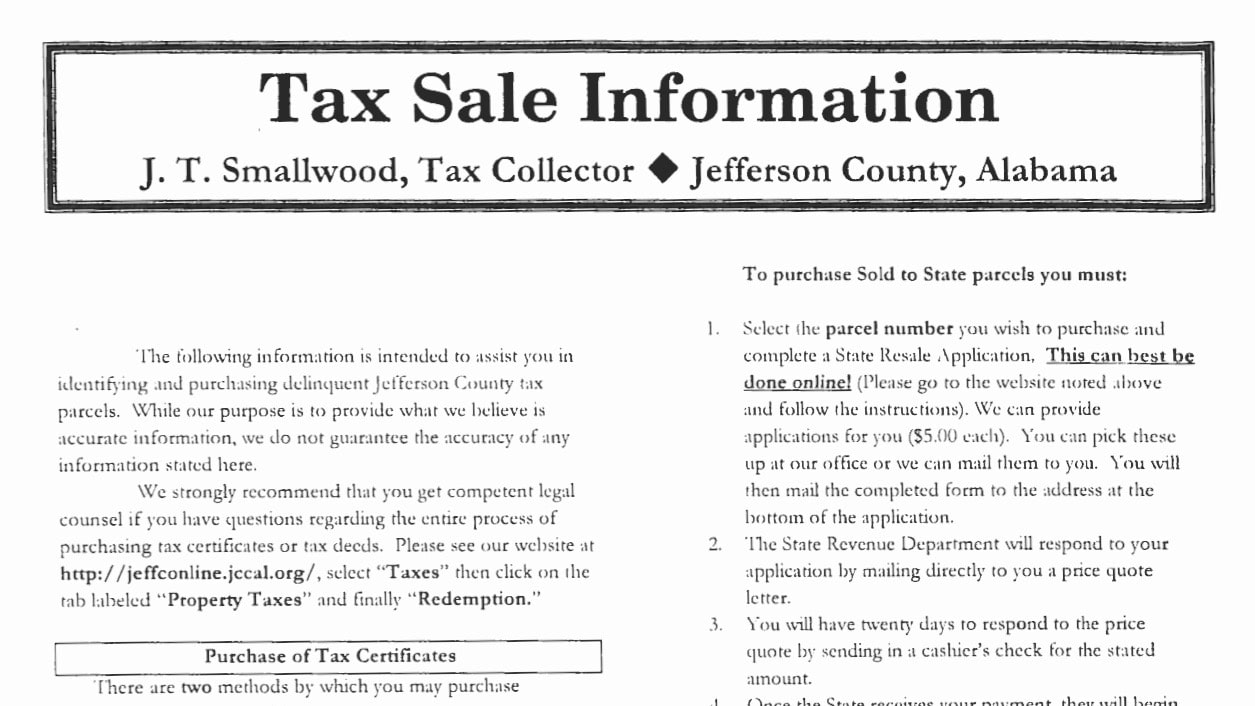

Alabama uses the premium bidding method at the tax sale.

. WwwATLASSonline As an association ATLASS can advocate to county officials with some persuasion. Section 40-10-183 Tax lien sale list. The lien encumbers property and places competing creditors on notice that the state claims an interest in the property.

Tax liens are purchased with a 3 year redemption period and a 12 percent annual rate of return or 1 percent per month. Recording of the Training to Keep. Alabama Tax Lien Association تحتوي على ١٩٨ من الأعضاء.

Search Tax Delinquent Properties. The insiders have a big advantage with. The HOA or COA can usually get a lien on your home.

WwwATLASSonline As an association ATLASS can advocate to county officials with some persuasion. Alabama Tax Lien Association has 189 members. In other words there is not a continuous chain of title and a judge has to issue an order declaring you the rightful owner.

Basics of Alabama Lien Law Charles A. To provide for the exchange among the members of this Association of such information ideas techniques and procedures relating to the performance of their duties. The transcripts are updated weekly.

HB 354 would revise the tax lien sale procedures for counties to authorize tax liens to be sold. Some counties pay interest on both the minimum and premium bid amounts. Shared files and info.

The purpose of this Association shall be to bring together by association communication and organization public officials who administer the ad valorem tax laws of Alabama. Ad Buy Tax Delinquent Homes and Save Up to 50. WwwATLASSonline As an association ATLASS can advocate to county officials with some persuasion.

Just remember each state has its own bidding process. The lien is usually recorded in the Office of the Judge of Probate of the county where the taxpayer resides or owns property. WwwATLASSonline As an association ATLASS can advocate to county officials with some persuasion.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. The Alabama Department of Revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help them complete the quiet title action and become the undisputed owner. 2-Hour Intensive Alabama Over-the-Counter Tax Deed Property Investment Training taught by Tony Martinez Jeremy Moore.

Close About Us Tax Lien Facts Free Lessons Blog Contact Us. Home Study Course Ultimate Listing Service. Adoption of sale procedure.

Get the Property Every Time Training. Article 7 Sale of Tax Liens. CONFERENCE Saturday 3 October 2020.

Under existing law counties have the option to sell their outstanding tax liens on real property. View How to Read County Transcript Instructions. Thoughts on Newbie mistakes from Alabama Tax Lien Association member lunchwwwATLASSonline.

Section 40-10-181 Tax lien defined. The purchaser of the tax liens obtains the right to collect all delinquent taxes penalties interest and costs with respect to the property. Get the Property Every Time - Texas with Dan Simsiman.

Each HOA is different and they have their own governing documents fees assessments rules lien authority and other penalties. The insiders have a big advantage with county officials when it comes to simply voiding a sale for no reason. If you do not see a tax lien in Alabama AL or property that suits you at this time subscribe to our email alerts and we will update you as new Alabama.

The association typically can charge you for overdue assessments late charges fines other charges interest and reasonable attorneys fees and costs. The taxpayer will be unable to sell or transfer his property until the tax lien has been paid. Ad Understand How Tax Liens Deeds Work In Free Online Course.

Act 2018-577 signed by Gov. Section 40-10-180 Legislative findings. Facts Free Lessons Blog Contact.

Consumers should ask for the information they need. The insiders have a big advantage with county officials when it comes to simply voiding a sale for no reason We can advocate at the state level for better laws concerning tax liens as ATLASS. Some HOAs are more or less restrictive.

Below is a listing by county of tax delinquent properties currently in State inventory. Transcripts of Delinquent Property. Check your Alabama tax liens rules.

In Alabama if your home is part of an HOA or COA and you fall behind in assessments. To access the exclusive recording simply enter your Login Password below. Ray IV Lanier Ford Shaver Payne PC.

Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Register for 1 to See All Listings Online.

The majority of the counties use a premium bidding system when auctioning the tax liens. THE ASSOCIATION OF ALABAMA TAX ADMINISTRATORS Sample Tax Lien Auction and Sale Process Information Property Tax Courses 21-22 Annual Dues Statement 2021-22 MEETING INFORMATION License Conference December 8-9 2021 Marriott Prattville Hotel Conf Ctr 2500 Legends Cir Prattville AL 36066 334 290-1235 Registration Form Agenda Reservation Link. 12-Page Alabama Step-by-Step Investment Blueprint.

Sale to be in lieu of other remedies. Live Discussion and QA Session. Section 40-10-182 Tax liens subject to sale.

ALABAMA Code 35-11-213 mandates that a notarized ALABAMA Statement Of Lien can be recorded at any time up to four 4 months Subcontractors or six 6 months GeneralPrime Contractors after the last day providing equipment labor materials or services for a private Commercial project. 2101 West Clinton Ave Suite 102 Huntsville AL 35805 256-535-1100. The insiders have a big advantage with county officials when it.

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

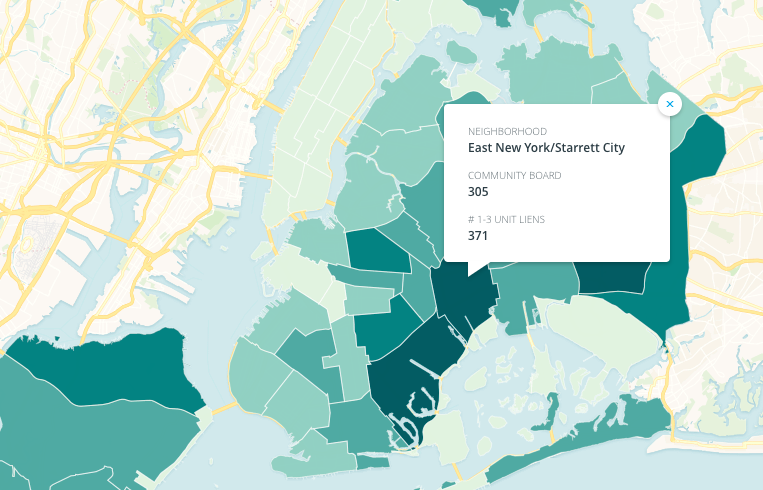

Activists And Lawmakers Call To Abolish City S Tax Lien Sale Bklyner

Property Tax Liens Treasurer And Tax Collector

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Nelson Mullins Tax Sale Investing Preventing Fallout On Other Lienholders

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien E Tax Deed Cosa Sono I Tax Liens Certificate 2 Tlc Tax Refund Accounting Tax

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

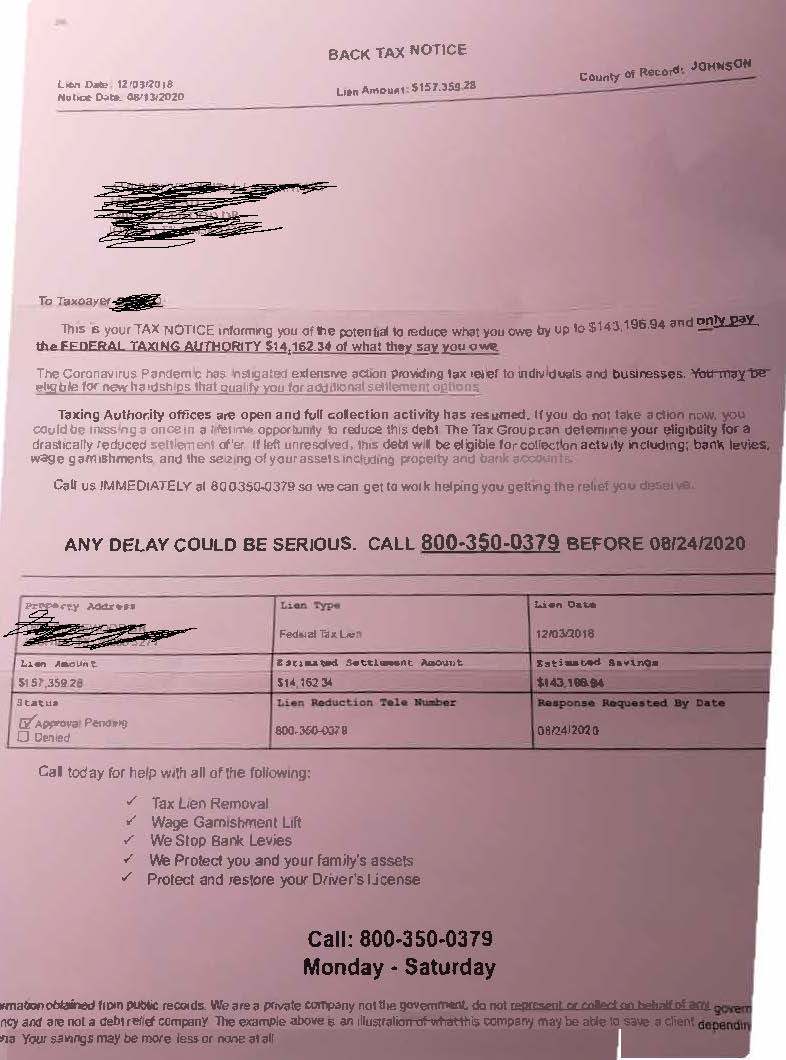

Analysis Of A Junk Tax Lien Letter Washington Tax Services

Property Tax Liens Treasurer And Tax Collector

Activists And Lawmakers Call To Abolish City S Tax Lien Sale Bklyner

Alabama Tax Lien Association Atlass United States

Tax Sale Maryland Daily Record

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification